Business Reporter

The Zimbabwe Revenue Authority (Zimra) says net revenue collections for the third quarter to September 2020 stood at $57 billion; representing a 27.16 percent increase above the quarterly target of $44.83 billion.

The out-turn far exceeds the $6.42 billion collected over the same period last year and nominally, the net revenue collections grew by 788.16 percent. All revenue heads registered positive growth in nominal terms.

Major contributors to net revenue collections for the quarter were: Individuals (15.26 percent), companies (14.63 percent), excise duty (14.17 percent), VAT on local sales (13.24 percent) and VAT on imports (13.08 percent).

The 2020 national budget, at $63,6 billion, was underpinned by anticipated revenues of $58,6 billion and a financing gap of $5 billion (which is approximately 1,5 percent of gross domestic product.

Positive variances on major tax heads and overall collection targets have seen the Treasury recording budget surpluses that have been used to finance key infrastructure projects like roads, dams and bridges as well as intervene during periods of disaster.

Advertisement

Zimra said the momentum in revenue collection is expected to be gained in the last quarter of the year with the revenue collection target for the year having been increased to $172 billion.

The growth is expected to come from increased productivity with the opening up of more business sectors in the domestic economy.

In addition, the Government’s strategy to target low hanging fruits in various sub-sectors of the manufacturing industry is expected to attract the much- needed investment for domestic production.

Individual tax revenue recorded positive performance due to continuous salary adjustments and cost of living adjustments that employers offered to their employees to counter rising inflation.

Company tax was mainly driven by the relaxation of lockdown conditions, resulting in more businesses resuming operations, restrictions of imports in line with Covid-19 measures as well as ongoing compliance enforcement projects.

VAT on local sales registered a positive performance in both gross and net terms due to increased operations by businesses, enforcement of the use of fiscal devices by registered operators.

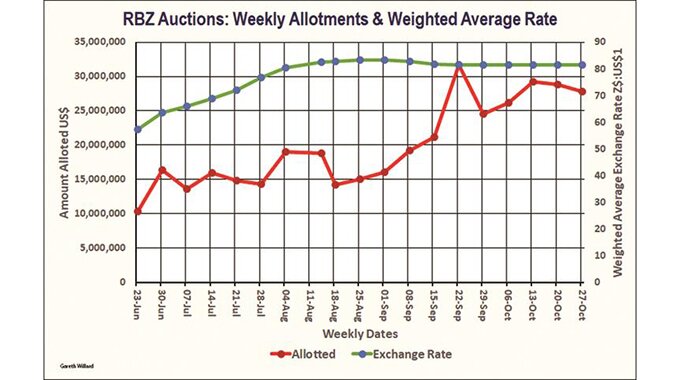

Growth in VAT on imports was mainly attributed to the diligence displayed by staff when clearing consignments and the prevailing exchange rates used in the calculation of taxes on imports.

Customs Duties, which are usually among the top five contributors, only contributed 9.40 percent due to the impact of the lockdown on imports.

The intermediated money transfer tax (2 percent) lost its momentum, missing the target of $5,860 billion by 32.23 percent and contributing only 6.86 percent to total revenue for the quarter.

This was partly due to the monetary policy interventions introduced to harness the local currency depreciation that was threatening economic stability.

Advertisement

Mining royalties, withholding taxes and other taxes missed the quarterly targets, mainly due to operational challenges in the mining sector caused by energy shortages and the Covid-19 pandemic.

– HERALD